45 coupon rate of bond

Current Coupon Definition - Investopedia In particular, the bond must have a coupon rate that falls within 0.5% above or below current market rates. Current coupon bonds are typically less volatile and are more liquid than other bonds... Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the yield that a bond pays annually. The coupon rate is calculated as the sum of all periodic interest payments made on a bond divided by the face value of that bond. The coupon rate will typically be lower than the stated interest rate, which is also referred to as a nominal interest rate or nominal yield.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Coupon rate of bond

How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =... smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.984% yield. 10 Years vs 2 Years bond spread is -18.6 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

Coupon rate of bond. BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ... Quant Bonds - Variable Coupons - BetterSolutions.com coupon = floating rate interest rate The price of a floating rate bond is always equal to its face value (show the proof) Two relationships between spot and forward rates You can use the short selling technique as a way of pricing a forward Reset Dates Floating Rate Note - Reverse/Inverse KEPCO bonds rate distorting wider bond market: experts Between Jan. 4 and June 22, the coupon rate for a two-year bond rose from 3.4 percent to 4.1 percent, while that of a three-year bond climbed from 3.9 percent to 4.3 percent. The bonds issued by... United Kingdom 10 Years Bond - Historical Data United Kingdom 10 Years Government Bond Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column contains prices at the current market yield. Other columns refers to hypothetical yields variations (100 bp = 1%). United Kingdom Government Bonds Back to United Kingdom Government Bonds - Yields Curve

I Bonds Can Help Protect Your Savings in the Face of Inflation Yes. There are two major catches. First, you can only buy up to $10,000 in I bonds. But if you've yet to file your tax return, you can also opt to receive up to $5,000 of your refund as an I bond ... Below Par - Investopedia The coupon rate on the bond is 3.5%, and the market interest rate is also 3.5%. A few months later, forces within the economy push interest rates higher, and comparable bonds now offer a 4.0% rate.... US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.875%; Maturity 2052-05-15; ... Bond yields slip, ... Yield curve inversion between 10-year and 2-year rates reaches biggest point since 2000 July 13, 2022 CNBC.com. Government borrows ₧20B via sale of reissued T-bonds The reissued 10-year Treasury Bonds (T-bonds), which had a coupon rate of 7.25 percent, attracted total bids of P99.2 billion, making the auction more than four times oversubscribed.

What Is a Zero-Coupon Bond? - The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =... Singapore Government Bonds - Yields Curve The Singapore 10Y Government Bond has a 2.792% yield.. 10 Years vs 2 Years bond spread is 3.2 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.56% (last modification in July 2022).. The Singapore credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 25.56 and implied probability of default is 0.43%. Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... A coupon rate of 0.50% would be highest for a new TIPS since an auction on Jan. 17, 2019. ... They are zero-coupon bonds, meaning an investor buys them at a discount to par value. Instead of paying a coupon interest rate, T-bills are eventually redeemed at par value to create a positive yield to maturity. United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.103% yield. 10 Years vs 2 Years bond spread is 28.9 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

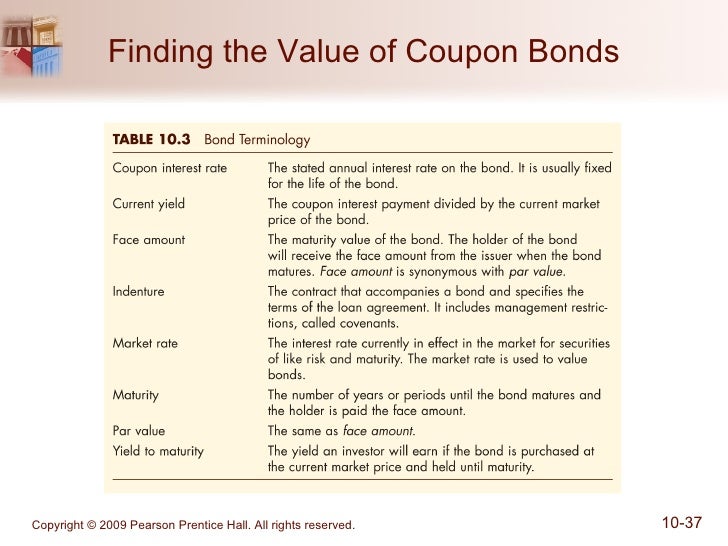

Par Value Definition - Investopedia The coupon rate is the interest payments that are made to bondholders, annually or semi-annually, as compensation for loaning the issuer a given amount of money. 6 For example, a bond with par...

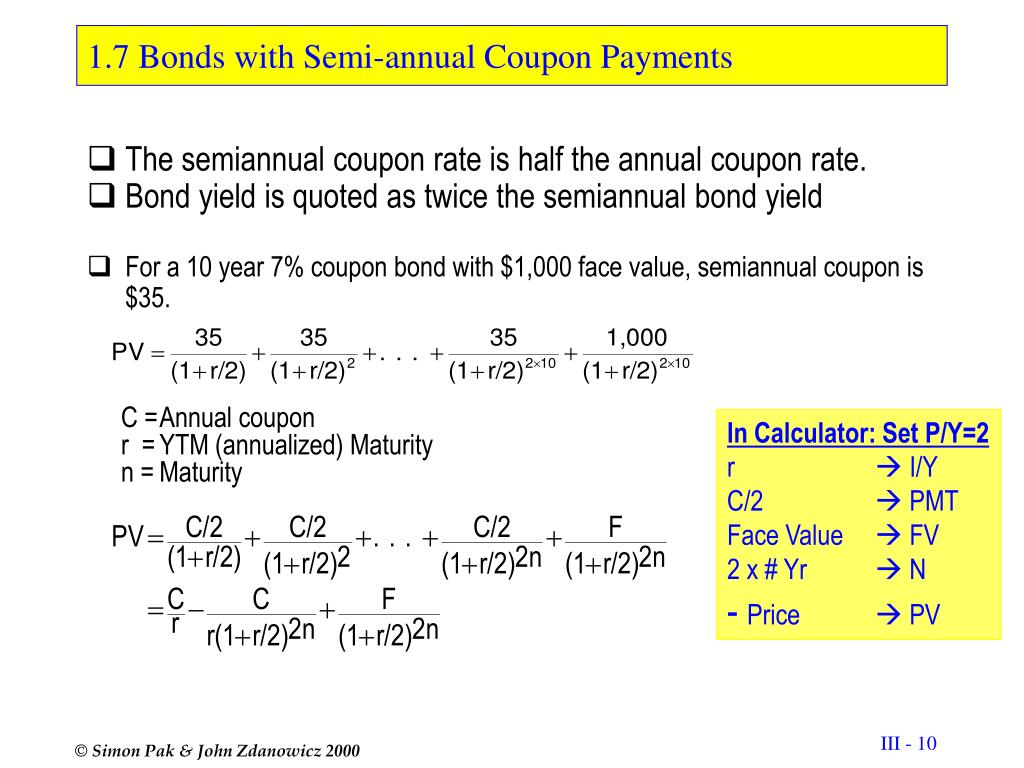

Basics Of Bonds - Maturity, Coupons And Yield A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.59%, compared to 3.64% the previous market day and 2.13% last year. This is lower than the long term average of 4.37%.

Learn with ETMarkets: 8 different types of bonds to invest in India The bondholder under Fixed-rate bonds earns guaranteed income irrespective of the market conditions and the finances of the issuer. For instance, an investor investing Rs 10,000 in government bonds with 10-year maturity and 7 per cent coupon rate will get Rs 700 fixed interest income annually for the next 10 years. • Floating-rate bonds

Fixing of coupon rates - Nykredit Realkredit A/S Fixing of coupon rates effective from 20 July 2022 Effective from 20 July 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly...

KEPCO bonds rate distorting wider bond market: experts Entertainment & Arts. K-pop; Films; Shows & Dramas; Music; Theater & Others; Sports

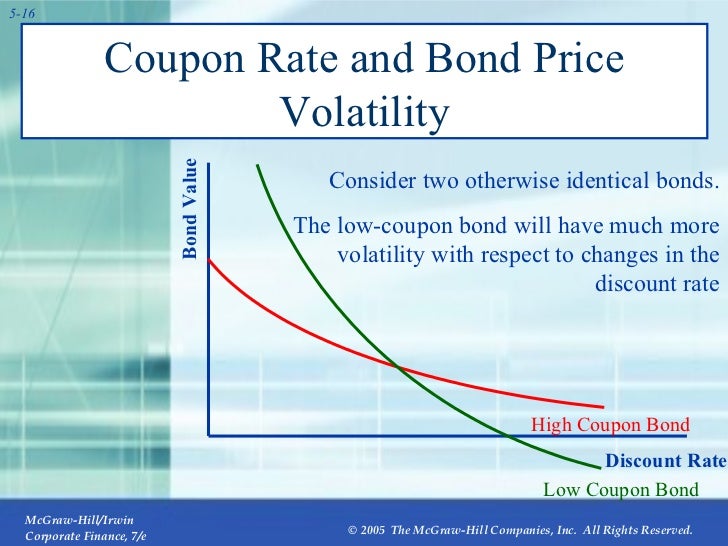

If Interest Rates Rise, What Happens to Bond Prices? The bond's coupon payment is the amount the bond pays in a year. That amount divided by the bond's market price determines the yield. Thus, bond yield is calculated as: Bond yield = Annual coupon payment / Bond price. Hence, if bond prices change, so do bond rates, and thus, yields. For example, suppose you have a $500 bond with an annual ...

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? Nov 18, 2021 · A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

30 Year Treasury Rate - YCharts Historically, the 30 year treasury yield reached upwards of 15.21% in 1981 when the Federal Reserve raised benchmark rates to contain inflation. The 30 Year yield also went as low as 2% in the low rate environment after the Great Recession. 30 Year Treasury Rate is at 3.22%, compared to 3.30% the previous market day and 2.10% last year.

Duration and Convexity to Measure Bond Risk - Investopedia However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of...

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.984% yield. 10 Years vs 2 Years bond spread is -18.6 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =...

Post a Comment for "45 coupon rate of bond"