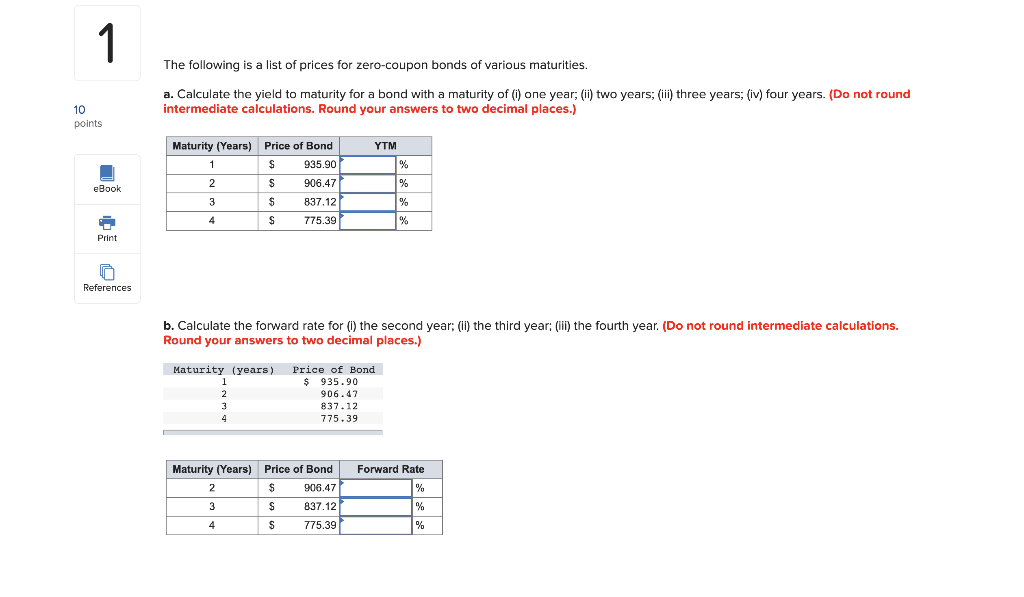

38 zero coupon bond yield calculation

› EN › MarketZero Coupon Yield Curve - The Thai Bond Market Association IRR Calculation; Bond Price. Search by Bond; Month-end MTM Prices; ... Bond Market Data; Yield Curve; Zero Coupon Yield Curve; Service Manager : Wat (0-2257-0357 ext ... New Zealand Government Bonds - Yields Curve The New Zealand 10Y Government Bond has a 4.145% yield. 10 Years vs 2 Years bond spread is -0.3 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.00% (last modification in August 2022). The New Zealand credit rating is AA+, according to Standard & Poor's agency.

YTM for a 0-coupon Bond with <1 year until Maturity : r/bonds The T-bills quotes I am looking at on Fidelity's website list an ask or bid price per $100, with a corresponding yield. For instance, looking at the quote for 912796YF0 at 2106 on 9/21, the bid price and yield are 99.809 and 2.492. The ask price and yield are 99.820 and 2.353. I can't find a formula that uses these prices and gives me these rates.

Zero coupon bond yield calculation

Intermediate Finance Questions - BrainMass For a $1,000 par bond maturing in 10 years with a coupon rate of 5% making annual interest payments and a market yield (ytm) of 5%, calculate the PV's of (1) and (2) above. (Hint: combined, they will total the par or future value of the bond of $1,000 since ytm = coupon rate). Show your calculations. (10 pts.) 2. Zambia Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Zambia Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. Domestic bonds: Norway, NTB 0% 20sep2023, NOK (NST 60, 364D) (NO0012697723) Yield / Duration - Calculator What is a calculator? Placement amount 14,000,000,000 NOK Outstanding amount 14,000,000,000 NOK USD equivalent 1,352,853,070.49 USD Denomination 1,000 NOK ISIN NO0012697723 CFI DYZTXR FIGI BBG019PCGRQ0 Ticker NGTB 0 09/20/23 60 Find Any Data on Any Bond in Just One Click

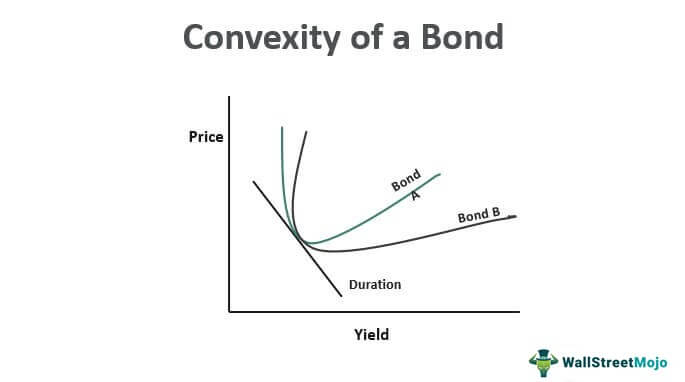

Zero coupon bond yield calculation. › convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield. › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: › terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 1.864% yield. 10 Years vs 2 Years bond spread is 6.1 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in September 2022). The Germany credit rating is AAA, according to Standard & Poor's agency. How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1)−1 Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: = ( 1000 925 ) ( 1 2 ) − 1 United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 3.329% yield. 10 Years vs 2 Years bond spread is -12.7 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. (Solved) - 9. Answer the following questions on bond valuation and ... 9. Answer the following questions ...

Pakistan Government Bonds - Yields Curve The Pakistan 10Y Government Bond has a 13.061% yield. Central Bank Rate is 15.00% (last modification in July 2022). The Pakistan credit rating is B-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 505.92 and implied probability of default is 8.43%. Calculating YTM of a four year default bond - BrainMass Zero- coupon YTM 3.25% 3.50% 3.90% 4.25% 4.40%. Consider a four year default free bond with an annual coupon rate of 4.5% and a face value of $100. The YTM on this bond is closest to: ... Yield to maturity calculations for bonds Description of Bond valuation Annual Coupon and Bonds H0A0, total return - Cbonds The FX-G10 includes all Euro members, the US, Japan, the UK, Canada, Australia, New Zealand, Switzerland, Norway and Sweden. Original issue zero coupon bonds, 144a securities (both with and without registration rights), and pay-in-kind securities (including toggle notes) are included in the index. Realized Compound Yield versus Yield to Maturity - Rate Return Figure 14.5 Growth of invested funds. Future value of first coupon payment with interest earnings $100 X 1.08 = $ 108 Cash payment in second year (final coupon plus par value) $1,100 Total value of investment with reinvested coupons $1,208

Yield to Call Calculator | Calculating YTC | InvestingAnswers To calculate a bond's yield to call, you'll need to know the: face value (also known as "par value") coupon rate number of years to the call date frequency of payments call premium (if any) current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900.

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate/2) ^ time to maturity*2 Price of Zero-Coupon Bond = $10,000 / (1.025) ^ 20 = $6,102.77 With semiannual compounding, we see the bond...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

General Cash Flows, Portfolios, and Asset Liability Management Calculate the one-year spot rate of a zero-coupon bond priced at $94 per $100 nominal. Solution Pn = (1 + sn) − n ⇒ 100(1 + sn) − 1 = 94 ∴ sn = ( 94 100) − 1 = 0.06382 = 6.82 The yield curve can also represent the redemption yields meaning it is not necessarily the spot rates. Discrete-time Forward Rates

› terms › bWhat Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Kenya Government Bonds - Yields Curve The Kenya 10Y Government Bond has a 14.113% yield. Click on Spread value for the historical serie. A positive spread, marked by , means that the 10Y Bond Yield is higher than the corresponding foreign bond. Instead, a negative spread is marked by a green circle.

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.770% yield. 10 Years vs 2 Years bond spread is 380 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.25% (last modification in September 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency.

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond Price}}\right)^ {\left (\frac {1} {\text {Years to Maturity}}\right)-1}\end {aligned} Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1)−1

Yield calculation formula - ReeceFareen The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. . To calculate dividend yield you divide the annual dividend per share by the current stock price. The real yield would thus. 210 200 200 36590 100 2027 Instance of Yield Suppose to procure a share for 100 USD with an element of 17.

Domestic bonds: Norway, NTB 0% 20sep2023, NOK (NST 60, 364D) (NO0012697723) Yield / Duration - Calculator What is a calculator? Placement amount 14,000,000,000 NOK Outstanding amount 14,000,000,000 NOK USD equivalent 1,352,853,070.49 USD Denomination 1,000 NOK ISIN NO0012697723 CFI DYZTXR FIGI BBG019PCGRQ0 Ticker NGTB 0 09/20/23 60 Find Any Data on Any Bond in Just One Click

Zambia Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Zambia Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

Intermediate Finance Questions - BrainMass For a $1,000 par bond maturing in 10 years with a coupon rate of 5% making annual interest payments and a market yield (ytm) of 5%, calculate the PV's of (1) and (2) above. (Hint: combined, they will total the par or future value of the bond of $1,000 since ytm = coupon rate). Show your calculations. (10 pts.) 2.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 zero coupon bond yield calculation"