41 irs quarterly payment coupon

DOR Estimated Tax Payments | Mass.gov Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. It's fast, easy, and secure. In addition, extension, return, and bill payments can also be made. Calculations. Before making an Income quarterly estimated payment, calculate online with the Quarterly Estimated Tax Calculator. Payments | Internal Revenue Service - IRS tax forms Pay your taxes, view your account or apply for a payment plan with the IRS. ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation Form 9465; Installment Agreement Request POPULAR FOR TAX PROS; Form 1040-X; Amend/Fix Return ...

Third quarter estimated tax payments due Sept. 15 IR-2020-205, September 9, 2020. WASHINGTON — The Internal Revenue Service today reminded the self-employed, investors, retirees and others with income not subject to withholding that third quarter estimated tax payments for 2020 are due September 15. Taxes are paid as income is received during the year through withholding from pay, pension or ...

Irs quarterly payment coupon

Drake - Federal Tax Payment Service Click the "Make a Federal Tax Payment" button below and you will be directed to the appropriate website that accepts your payment method of choice. PAYMENT METHODS FOR FEDERAL TAXES. Make a Federal Tax Payment Or click one of … PDF 2022 PA-40 ES INDIVIDUAL - Pennsylvania Department of Revenue Use the 2022 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SOCIAL SECURITY NUMBER (SSN) SSN - enter the primary taxpayer's nine-digit SSN without the hyphens. SSN - enter the spouse's nine-digit SSN without the hyphens. Estimated Quarterly Tax Payments: 1040-ES Guide & Dates - TaxCure You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online. Before making a payment, you need to sign up for the service. Sign up online, or call the above phone number to have a signup form mailed to you. You need your name, Social Security number, and bank account details for online enrollment.

Irs quarterly payment coupon. 2022 Form 1040-ES - IRS tax forms Go to IRS.gov/Payments to see all your payment options. General Rule In most cases, you must pay estimated tax for 2022 if both of the following apply. 1. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and refundable credits. 2. You expect your withholding and refundable credits About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR. Make a Payment | Minnesota Department of Revenue Individuals: Use the e-Services Payment System Some tax software lets you make or schedule payments when you file. To cancel a payment made through tax software, you must contact us. Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. Businesses: Log in to e-Services IRS Direct Pay Redirect Depending on your income, your payment may be due quarterly, or as calculated on Form 1040-ES, Estimated Tax for Individuals. You do not have to indicate the month or quarter associated with each payment. If you want to make a late estimated tax payment after January 31st (for last year), select Balance Due as the reason for payment.

2022 1040-ES Form and Instructions (1040ES) - Income Tax Pro Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the quarterly due dates for the 2022 tax year: April 18, 2022 June 15, 2022 September 15, 2022 January 17, 2023 Each quarterly estimated tax payment should be postmarked on or before the quarterly due date. Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax) Payment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ... PDF 2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding,

2022 Federal Quarterly Estimated Tax Payments | It's Your Yale 2022 Federal Quarterly Estimated Tax Payments Generally, the Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply: you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and Estimated Taxes | Internal Revenue Service - IRS tax forms This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two. About Form 1040-ES, Estimated Tax for Individuals Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you do not elect voluntary withholding, you should make estimated tax payments on other taxable ... PDF Form IT-2105 Estimated Income Tax Payment Voucher Tax Year 2022 Enter applicable amount(s) and total payment in the boxes to the right. Print the last four digits of your SSN or taxpayer ID number and 2022 IT‑2105 on your payment. Make payable to NYS Income Tax. Mail voucher and payment to: NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton NY 13902-4122. Enter your 2-character special

For those who make estimated federal tax payments, the first quarter ... IR-2022-77, April 6, 2022 WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others that the payment for the first quarter of 2022 is due Monday, April 18.

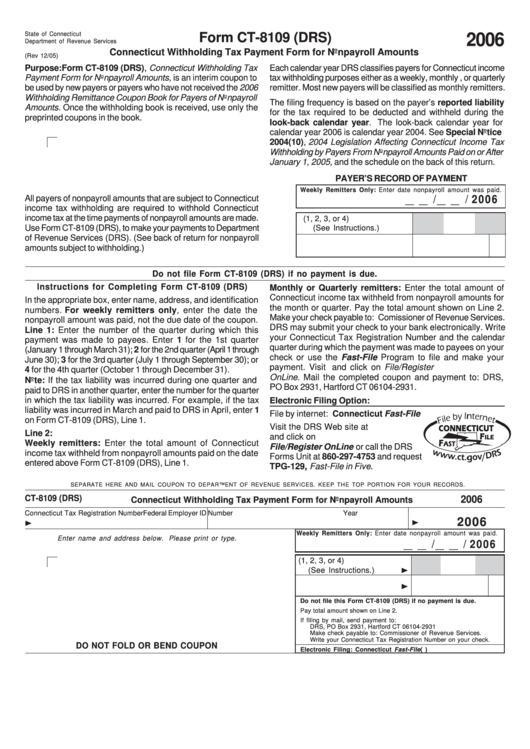

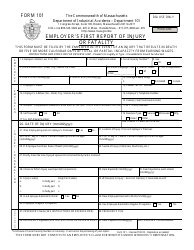

PDF Employer's Quarterly Tax Payment Coupon Employer's Quarterly Tax Payment Coupon STATE OF MICHIGAN RICK SNYDER GOVERNOR TALENT INVESTMENT AGENCY UNEMPLOYMENT INSURANCE AGENCY PO BOX 33598, DETROIT, MI 48232-5598 - (855) 484-2636 SHARON MOFFETT-MASSEY, UIADIRECTOR STEPHANIE COMAI DIRECTOR TIA is an equal opportunity employer/program.

Estimated Tax Payments for Individuals - Marylandtaxes.gov If your employer does withhold Maryland taxes from your pay, you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount withheld by your employer by more than $500. If you receive $500 or more in income from awards, prizes, lotteries, racetracks or raffles, you must file Form ...

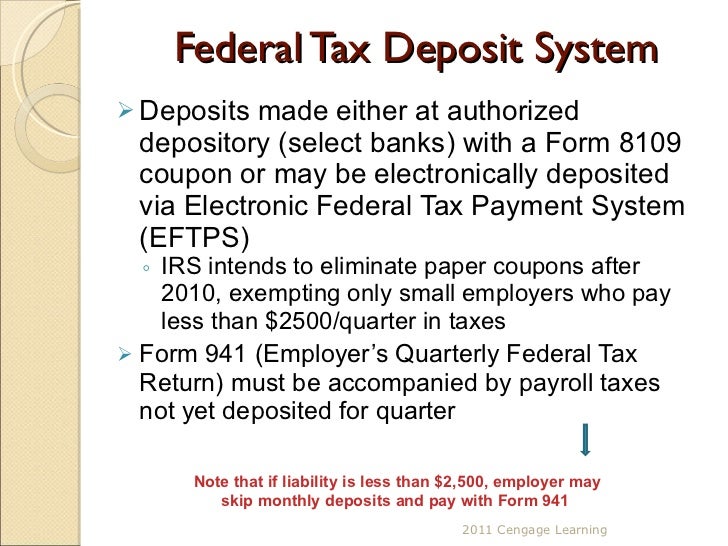

ELECTRONIC FEDERAL TAX PAYMENT SYSTEM PAYMENT … Employer’s Quarterly Federal Tax Return Return by a U.S. Transferor of Property to a Foreign Corporation 01–12 01–12 ... Payment due on an IRS notice Payment due with a return Payment due on an IRS notice Payment due on an extension …

IRS Federal Tax Underpayment Penalty & Interest Rates | Intuit IRS interest rates will remain unchanged for the calendar quarter beginning April 1, 2021. The rates will be: 3% for overpayments (2% in the case of a corporation); 3% for underpayments; and; 5% for large corporate underpayments.

Make a Payment - Pennsylvania Department of Revenue Make a Payment. Personal Income Tax Payment. Business Tax Payment. Inheritance Tax Payment. Realty Transfer Tax Payment. Tom Wolf, Governor C. Daniel Hassell, Secretary.

Where To Mail Quarterly Tax Payments? (Best solution) - Law info The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201- 1300 USA. To make your estimated quarterly tax payments by mail, tear off the voucher at the bottom of Form 1040-ES and mail it to the IRS. Include a check or money order for your payment.

Payments | Internal Revenue Service - IRS tax forms May 28, 2022 · Pay your taxes, view your account or apply for a payment plan with the IRS. Service Outages: Check Back Later This service is having outages that may keep you from successfully completing your session. Check back later. ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation

How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ...

Estimated Quarterly Tax Payments: 1040-ES Guide & Dates - TaxCure You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online. Before making a payment, you need to sign up for the service. Sign up online, or call the above phone number to have a signup form mailed to you. You need your name, Social Security number, and bank account details for online enrollment.

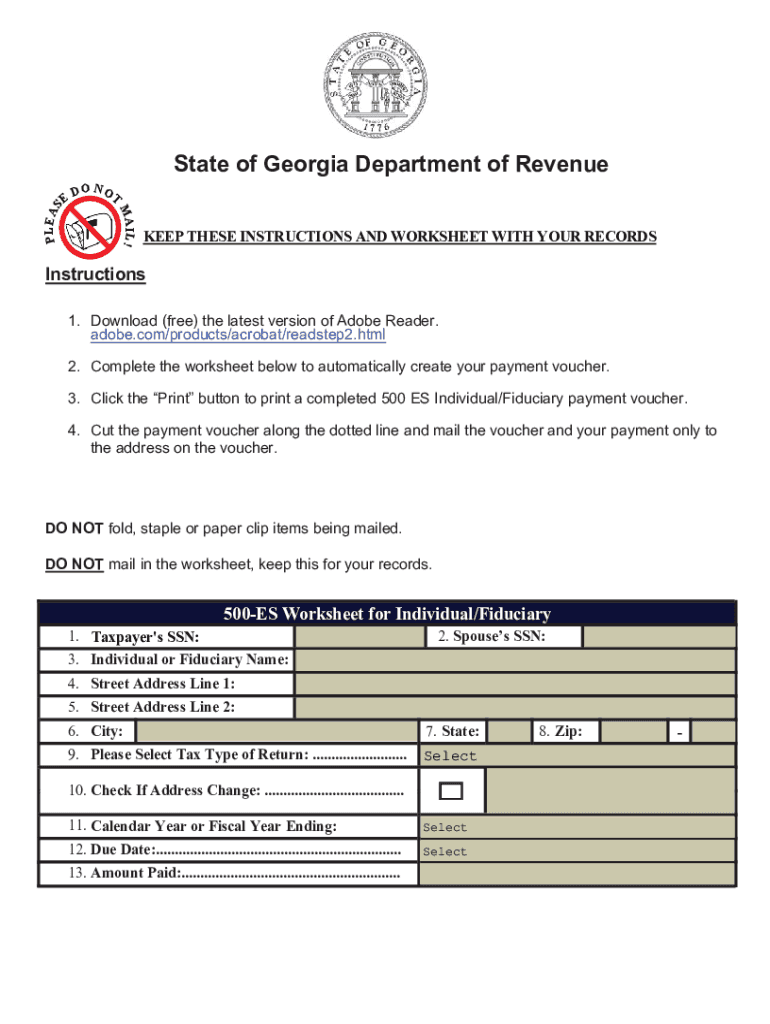

PDF 2022 PA-40 ES INDIVIDUAL - Pennsylvania Department of Revenue Use the 2022 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SOCIAL SECURITY NUMBER (SSN) SSN - enter the primary taxpayer's nine-digit SSN without the hyphens. SSN - enter the spouse's nine-digit SSN without the hyphens.

Drake - Federal Tax Payment Service Click the "Make a Federal Tax Payment" button below and you will be directed to the appropriate website that accepts your payment method of choice. PAYMENT METHODS FOR FEDERAL TAXES. Make a Federal Tax Payment Or click one of …

Post a Comment for "41 irs quarterly payment coupon"