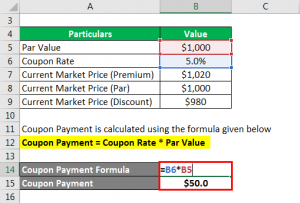

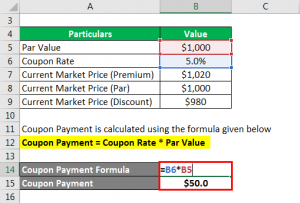

› bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond’s face value with the coupon rate.

Yield to maturity of a coupon bond formula

How to calculate yield to maturity in Excel (Free Excel Template)

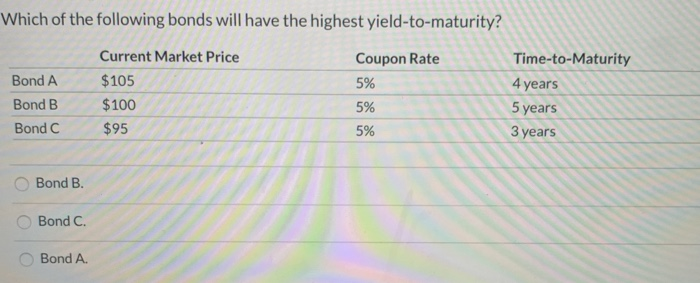

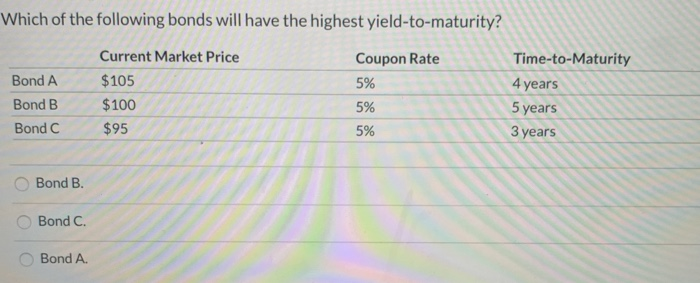

Solved: Which Of The Following Bonds Will Have The Highest... | Chegg.com

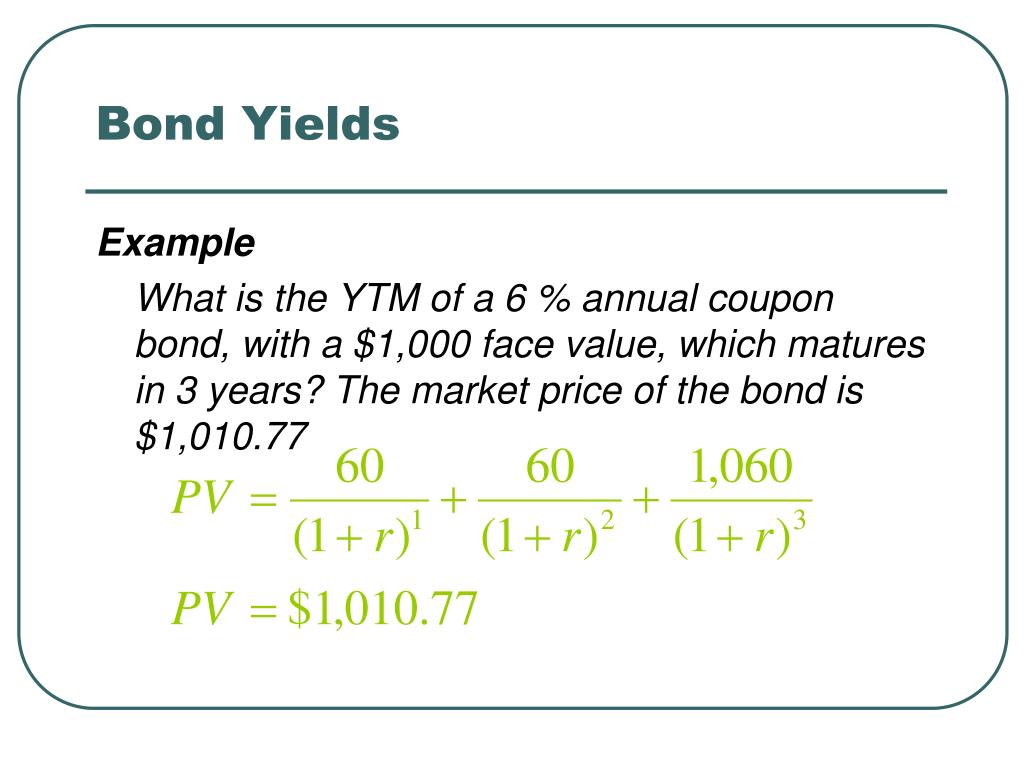

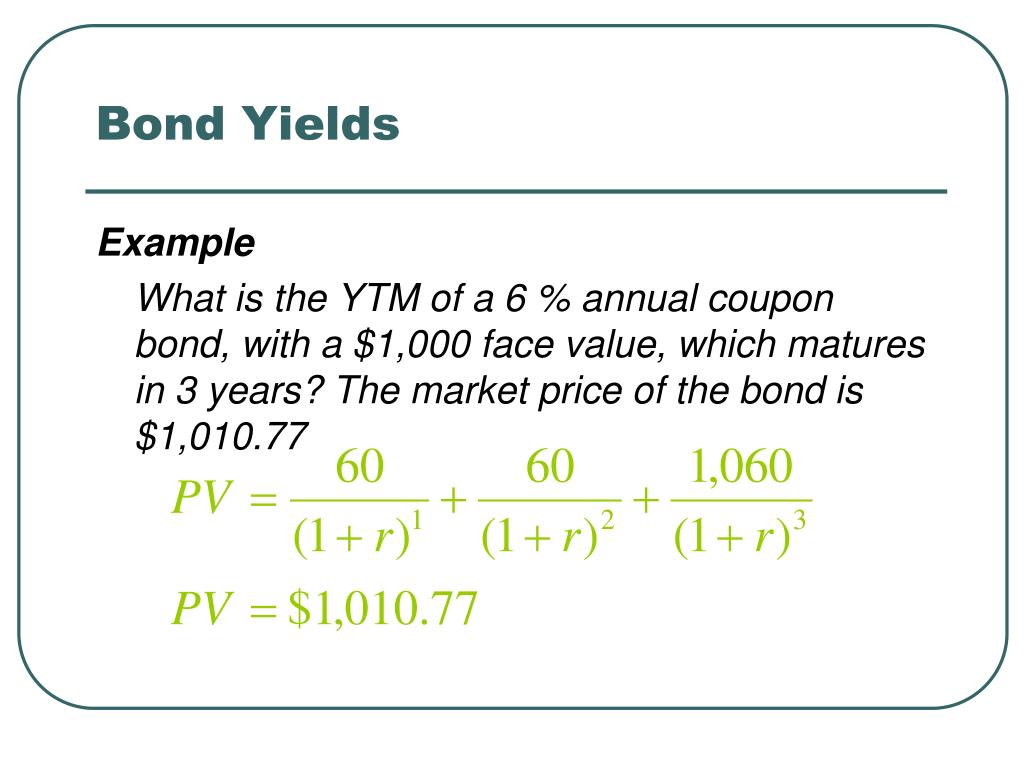

Efficient Market Hypothesis Valuation of Bonds

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://www.finpricing.com/images/zero-coupon-bond-valuation-FinPricing.jpg)

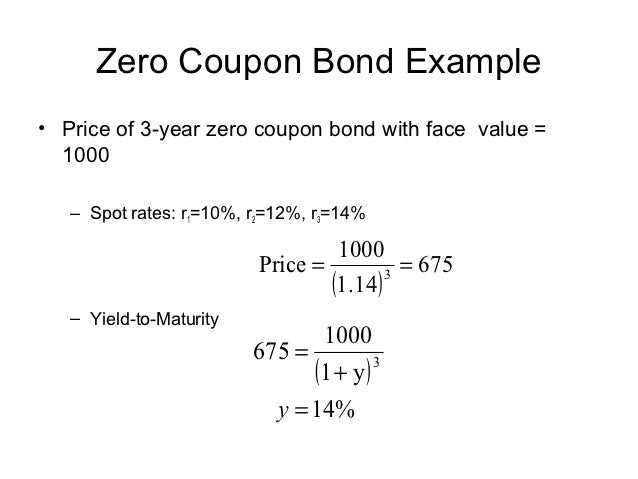

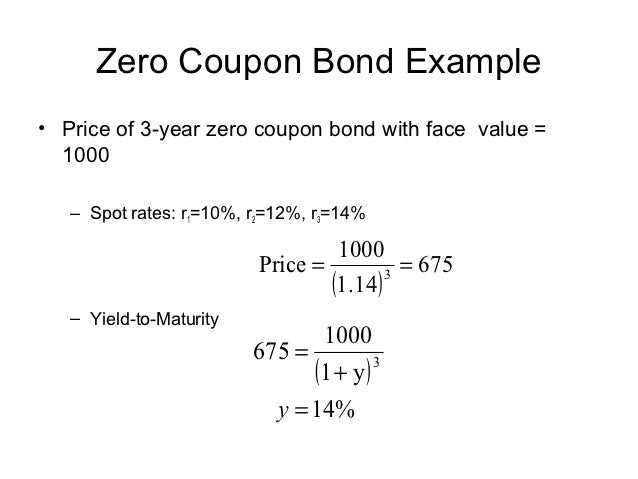

[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...

Bond valuation phd

PPT - Yield To Maturity Formula PowerPoint Presentation - ID:2938012

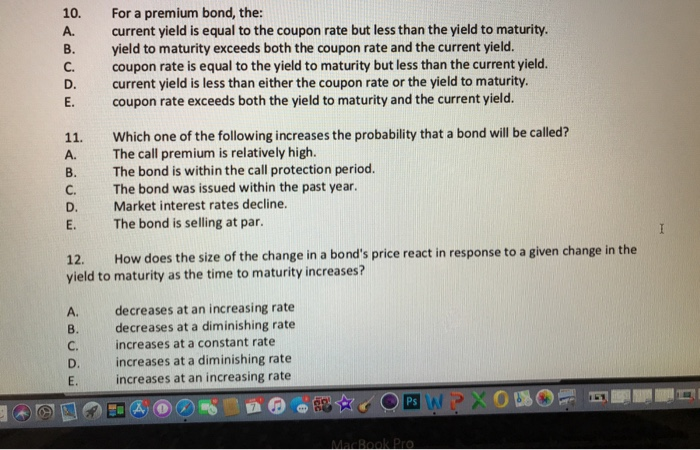

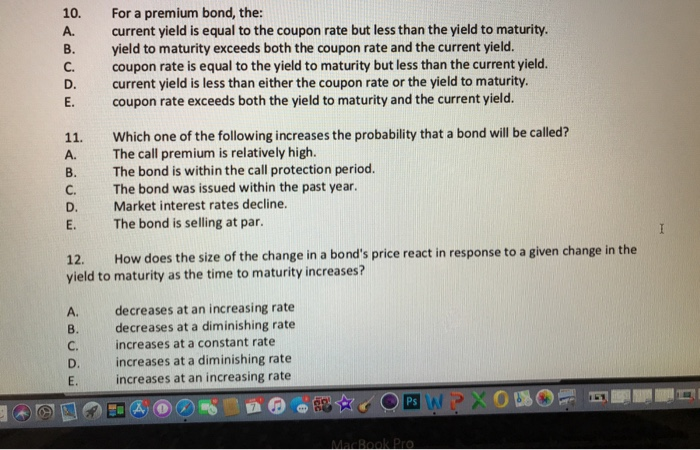

Solved: 10. For A Premium Bond, The: A. Current Yield Is E... | Chegg.com

PPT - Financial Risk Management PowerPoint Presentation, free download ...

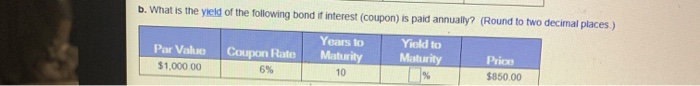

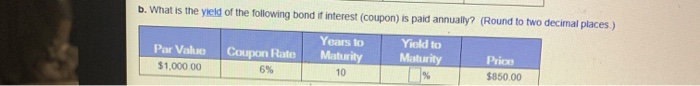

Yield to maturity. What is the yield of each of the | Chegg.com

PPT - Bond valuation PowerPoint Presentation - ID:833716

Bond Pricing Formula | How to Calculate Bond Price? | Examples

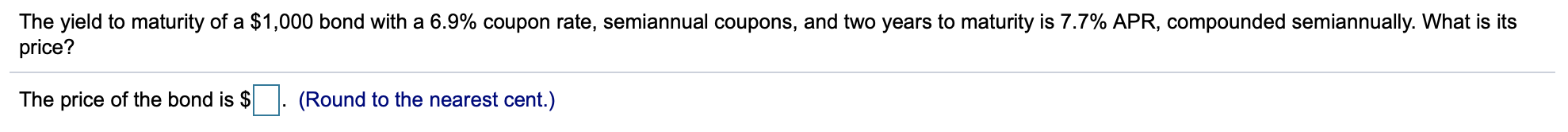

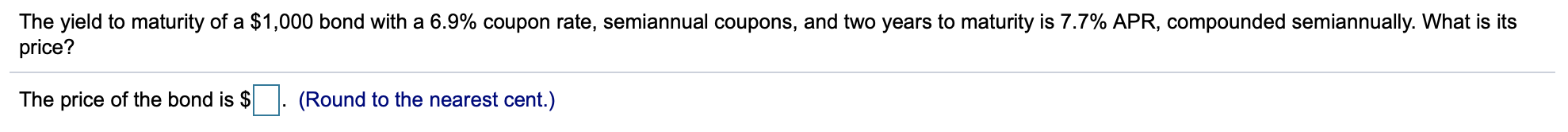

Solved: The Yield To Maturity Of A $1,000 Bond With A 6.9%... | Chegg.com

:max_bytes(150000):strip_icc()/ytm_ex_3-5bfd887a46e0fb0051d5e8da)

Definition Yield To Maturity - defitioni

Formule Yield To Maturity - Formule

Bond Yield to Maturity Calculator - DQYDJ

Bond Yield Formula | Calculator (Example with Excel Template)

Bond Formula | How to Calculate a Bond | Examples with Excel Template

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://www.finpricing.com/images/zero-coupon-bond-valuation-FinPricing.jpg)

Post a Comment for "41 yield to maturity of a coupon bond formula"