38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg | Course Hero View D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg from AE MISC at Wilmington University. KNOWLEDGE CH ECK If the yield on a fixed—coupon bond goes up, does the ... en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.

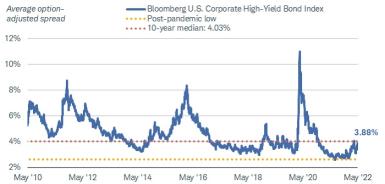

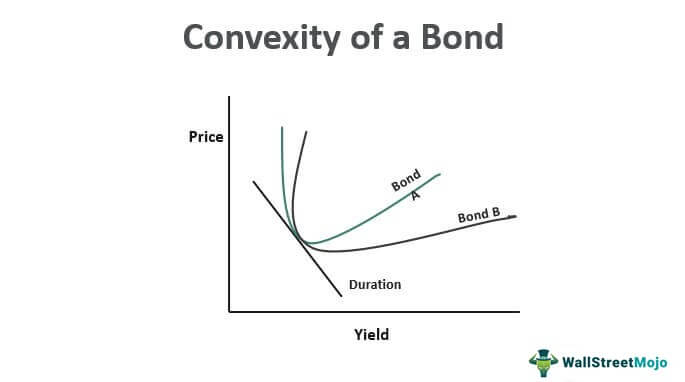

If the yield on a fixed coupon bond goes up, does the borrower ... Dec 27, 2020 ... No. The borrower does not pay more interest. “…the yield on a fixed coupon bond goes up…” means that the price of the bond declines.

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

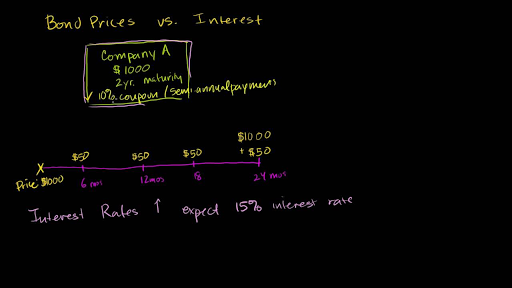

Bond Coupon Interest Rate: How It Affects Price - Investopedia When new bonds are issued with higher interest rates, they are automatically more valuable to investors, because they pay more interest per year, compared to ... › newsLatest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol. › bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market.

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. If the yield on a fixed-coupon 'bond goes up, does the borrower... (1 ... Mar 27, 2021 ... If the yield on a fixed- ... › en-us › moneyStock Quotes, Business News and Data from Stock Markets | MSN ... Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ... Solved KNOWLEDGE CHECK If the yield on a fixed-coupon bond Transcribed image text: KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Yes, the price goes up. Solved If the yield on a fixed-coupon 'bond goes up, does | Chegg.com Transcribed image text: If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up.

Bonds - FinOwlish Bond prices are inversely correlated with interest rates: when rates go up, bond prices fall and vice-versa. Bonds have maturity dates at which point the ... If the yield on a fixed-coupon bond goes up, does the borrower have ... If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down. The payments are fixed. › terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments.

› terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Relationship Between Interest Rates & Bond Prices - Investopedia Most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, driving up demand and the price of the bond. Government Securities Market in India – A Primer 14, How does one get information about the price of a G-Sec? ... Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at ... › bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market.

› newsLatest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

Bond Coupon Interest Rate: How It Affects Price - Investopedia When new bonds are issued with higher interest rates, they are automatically more valuable to investors, because they pay more interest per year, compared to ...

.png)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Post a Comment for "38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"