39 present value of zero coupon bond calculator

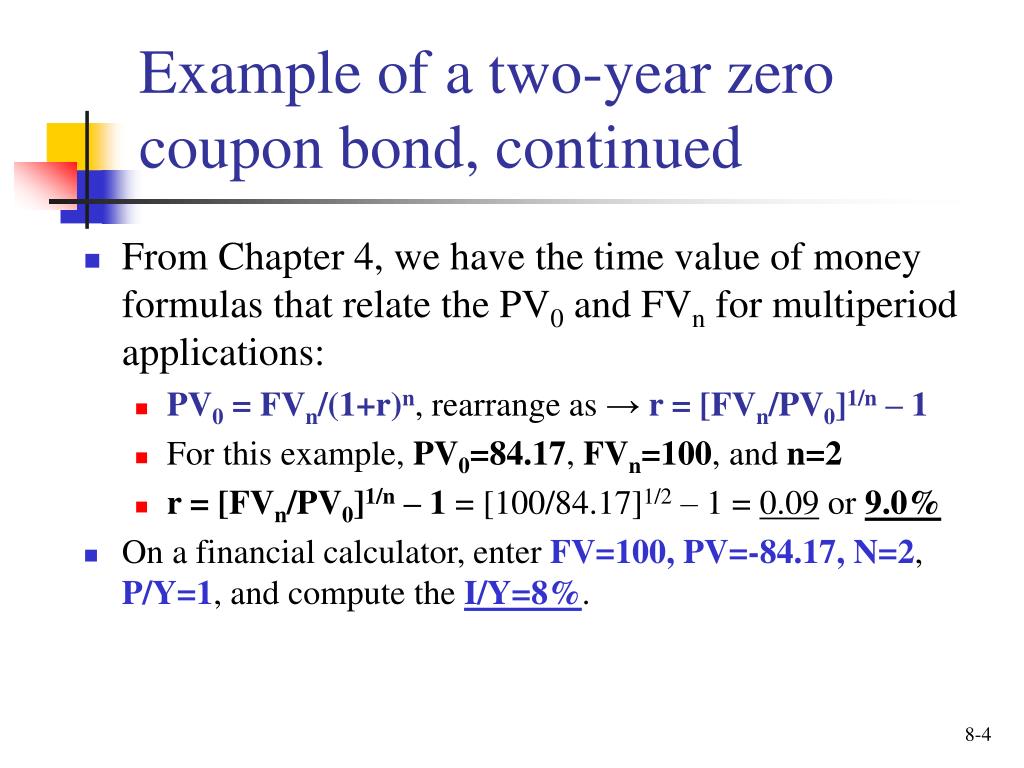

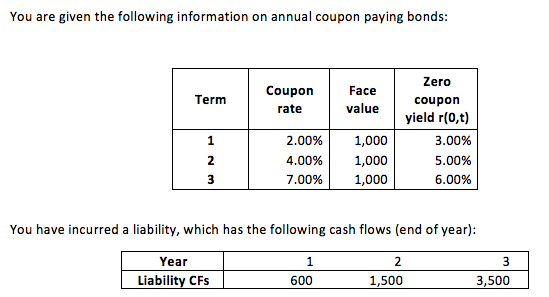

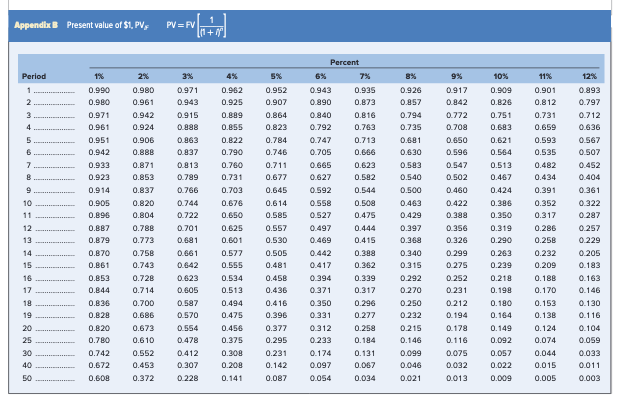

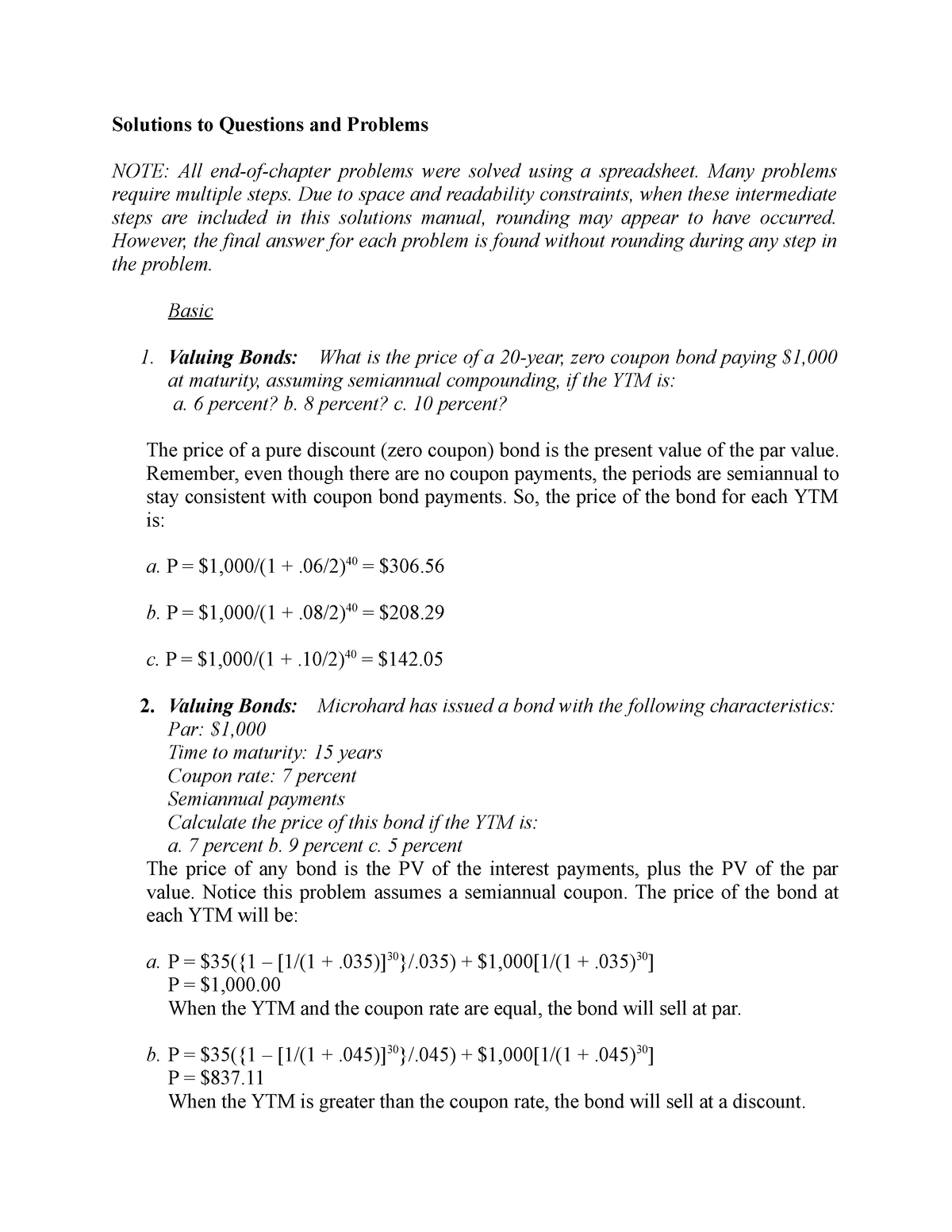

› terms › pWhat Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... › calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

› bond-yield-calculatorBond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

Present value of zero coupon bond calculator

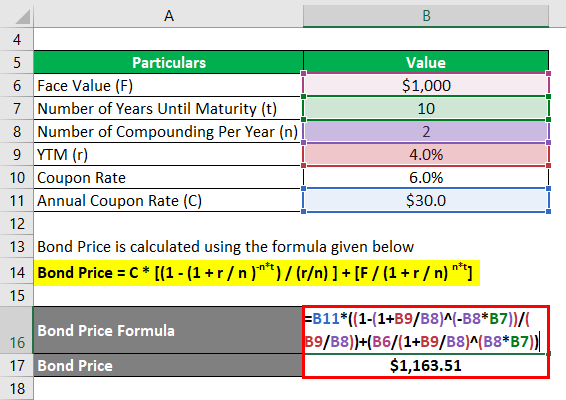

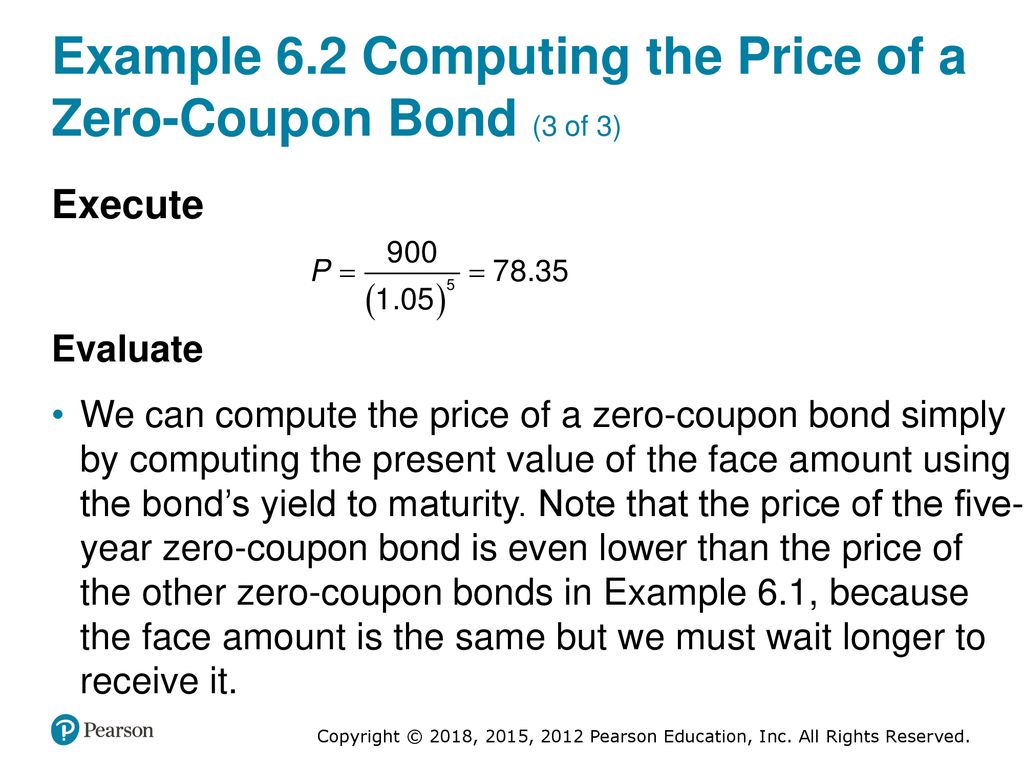

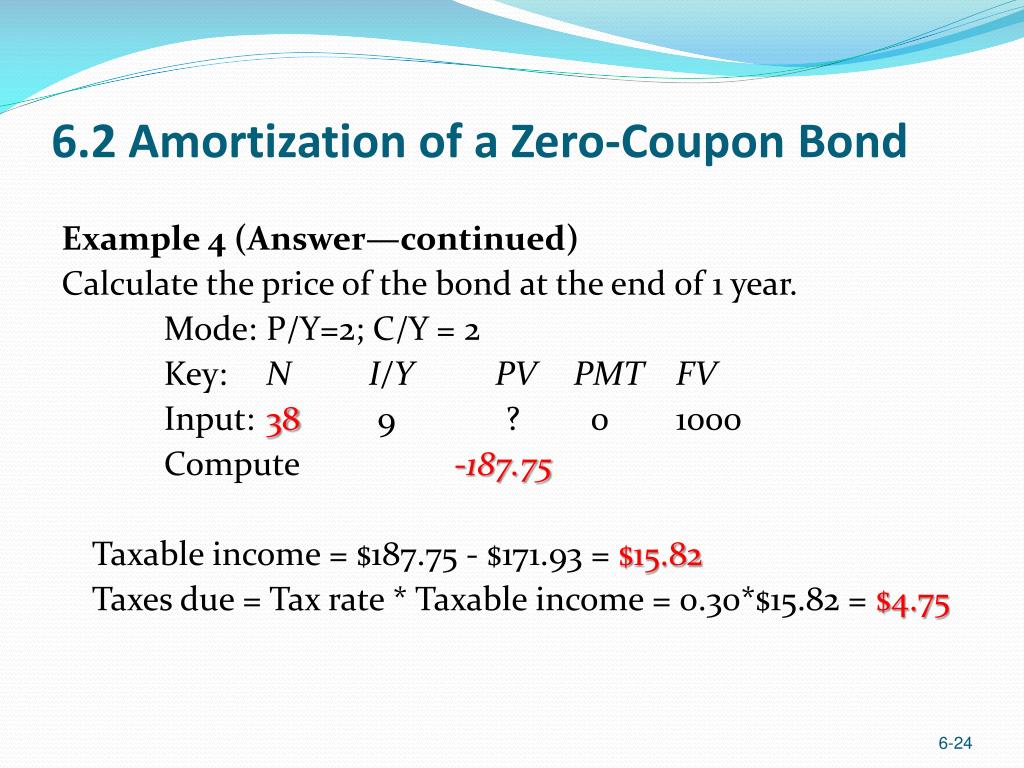

stablebread.com › calculators › present-valuePresent Value Annuity Factor (PVAF) Calculator | StableBread Zero Coupon Bond Value Calculator; Debt and Loans. After-Tax Cost of Debt Calculator; ... Calculator; Present Value of Annuity Continuous Compounding (PVACC) Calculator; › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ... › financial › npv-calculatorNet Present Value Calculator - CalculateStuff.com Once we calculate the present value of each cash flow, we can simply sum them, since each cash flow is time-adjusted to the present day. Once we sum our cash flows, we get the NPV of the project. In this case, our net present value is positive, meaning that the project is a worthwhile endeavor.

Present value of zero coupon bond calculator. › retirement › calculatingCalculating Present and Future Value of Annuities - Investopedia Apr 25, 2022 · Here is how to calculate the present value and future value of ordinary annuities and annuities due. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Corporate Finance. › financial › npv-calculatorNet Present Value Calculator - CalculateStuff.com Once we calculate the present value of each cash flow, we can simply sum them, since each cash flow is time-adjusted to the present day. Once we sum our cash flows, we get the NPV of the project. In this case, our net present value is positive, meaning that the project is a worthwhile endeavor. › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ... stablebread.com › calculators › present-valuePresent Value Annuity Factor (PVAF) Calculator | StableBread Zero Coupon Bond Value Calculator; Debt and Loans. After-Tax Cost of Debt Calculator; ... Calculator; Present Value of Annuity Continuous Compounding (PVACC) Calculator;

Post a Comment for "39 present value of zero coupon bond calculator"