39 t bill coupon rate

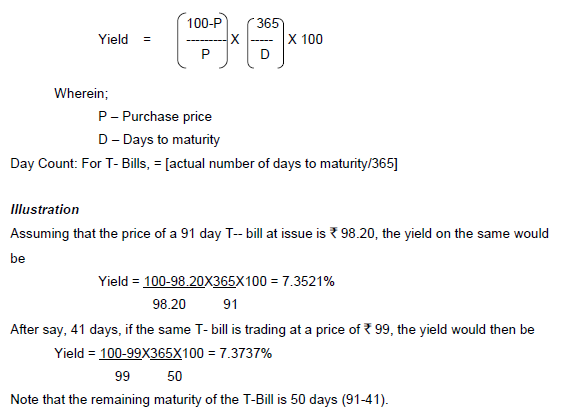

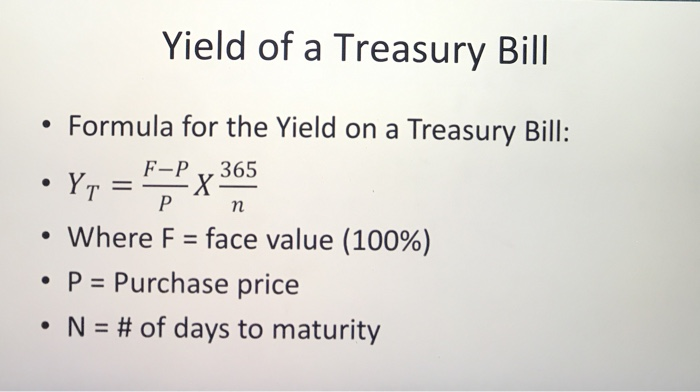

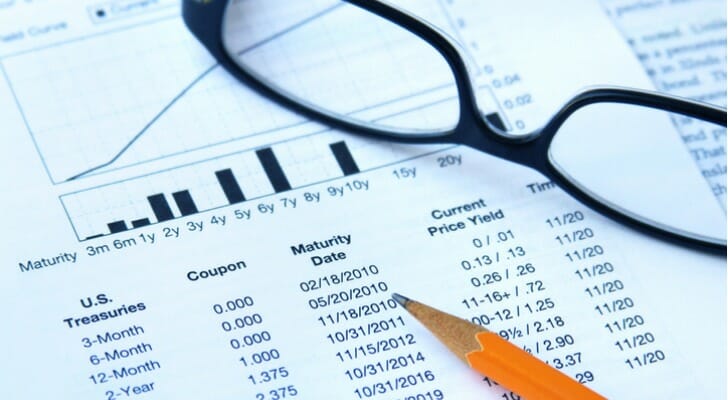

Understanding Pricing and Interest Rates — TreasuryDirect A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes Treasury Bills - Guide to Understanding How T-Bills Work The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills

Pop Culture: Entertainment and Celebrity News, Photos & Videos - Today Entertainment and celebrity news, interviews, photos and videos from TODAY.

T bill coupon rate

myspace.com › pages › blogMyspace Blog You're now in slide show mode. Hitting < pauses the slideshow and goes back. Hitting > pauses the slideshow and goes forward. SPACEBAR resumes the slideshow. 2 Year Treasury Rate - YCharts The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 4.28%, compared to 4.30% the previous market day and 0.35% last year. Best Rewards Credit Cards for 2019 | Credit.com Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card. Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit ...

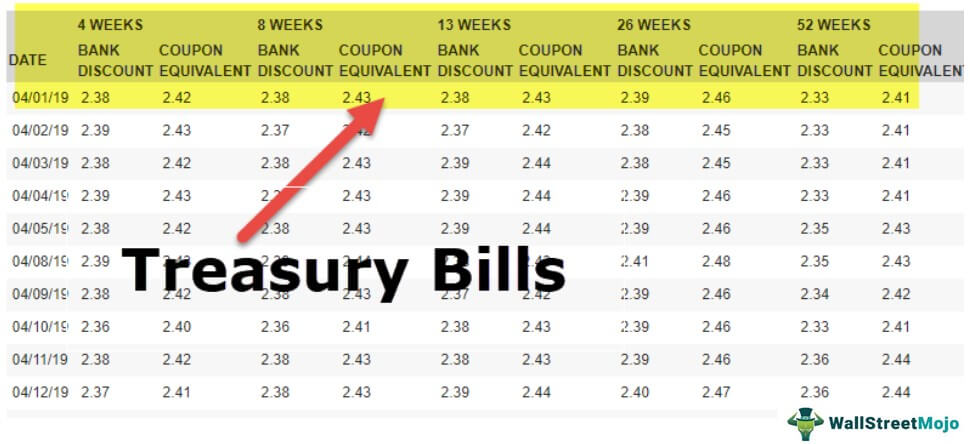

T bill coupon rate. › terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? T-bills are short-term government debt instruments with maturities of one year or less, and they are sold at a discount without paying a coupon. T-Notes represent the medium-term maturities of 2,... Resource Center | U.S. Department of the Treasury Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates ... COUPON EQUIVALENT 13 WEEKS BANK DISCOUNT COUPON EQUIVALENT 26 WEEKS BANK DISCOUNT COUPON EQUIVALENT 52 WEEKS BANK DISCOUNT COUPON EQUIVALENT 1 Mo 2 Mo 3 Mo 20 Yr 30 Yr; 01/02/2002: N/A : N/A How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index...

HM Treasury - GOV.UK - United Kingdom HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ... Interest Rate Statistics | U.S. Department of the Treasury Oct 11, 2022 · To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Treasury Notes — TreasuryDirect Interest rate: The rate is fixed at auction. It doesn't change over the life of the note. It is never less than 0.125%. See Results of recent note auctions. Interest paid: Every six months until maturity: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid) › credit-cards › best-rewards-credit-cardBest Rewards Credit Cards for 2019 | Credit.com Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card. Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit ...

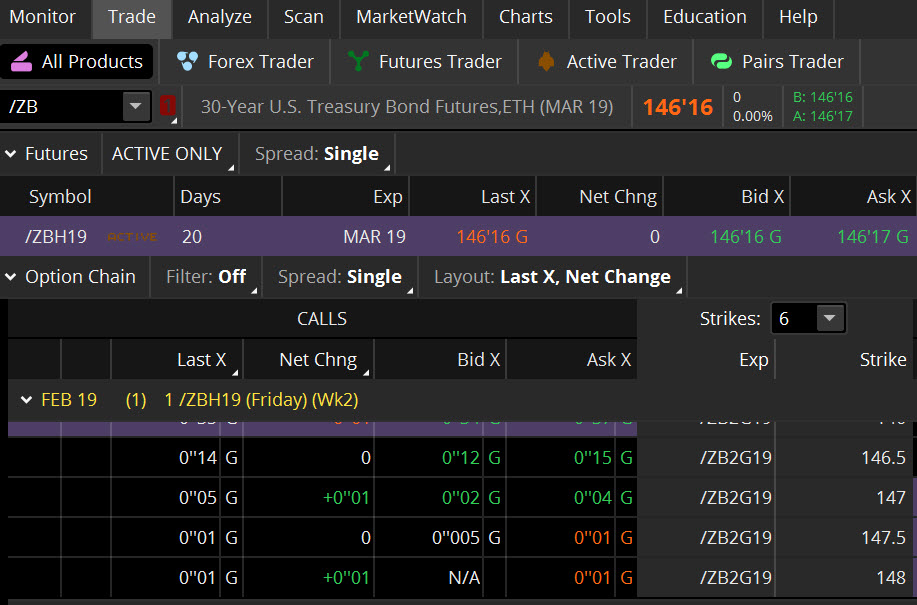

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction. TMUBMUSD01Y | U.S. 1 Year Treasury Bill Price & News - WSJ I Bond Rate Likely to Drop to 6.47%. 10/13/22; Real-Estate Companies Grapple With High Interest Rate Hedging Costs. 10/13/22; Evergrande's Debt-Crisis Fallout: Losses, Layoffs and More Defaults ... Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016 Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

› government › organisationsHM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

Myspace Blog You're now in slide show mode. Hitting < pauses the slideshow and goes back. Hitting > pauses the slideshow and goes forward. SPACEBAR resumes the slideshow.

TMUBMUSD06M | U.S. 6 Month Treasury Bill Overview | MarketWatch TMUBMUSD06M | A complete U.S. 6 Month Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

The Basics of the T-Bill - Investopedia The discount rate is calculated at the time of auction. Key Takeaways Treasury bills are debt obligations issued by the U.S. Department of the Treasury. T-bills have the shortest maturity date of...

› popculturePop Culture: Entertainment and Celebrity News, Photos ... - TODAY Entertainment and celebrity news, interviews, photos and videos from TODAY.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Historical Quotes Key Data Open 4.538% Day Range 4.288 - 4.538 52 Week Range -0.376 - 4.538 Price 4 17/32 Change 0/32 Change Percent 0.00% Coupon Rate 0.000% Maturity Oct 5, 2023 Performance Change...

How To Read A T-Bill Quote - Investopedia Simply replace the asking price with the bid price in the equation. 3*100/360=$0.83 $10,000-$0.83=$9,999.17 In this example, the seller is willing to accept $9,999.17 for a bill that will be...

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box.

91 Day T Bill Treasury Rate - Bankrate The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for various variable rate loans, particularly Stafford and PLUS education loans. Lenders...

Are T-Bills "coupon equivalent" rates based in annual terms? 1 According to treasury.gov, the "coupon equivalent" for a 1 month (4 weeks) T-Bill issued today is 0.99%. I happened to have purchased a 1 month T-Bill today for $99.9246. By my calculation that means that the return will be .075% (.0754/99.9246) for the month.

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

outlook.live.com › owaOutlook – free personal email and calendar from Microsoft Expand your Outlook. We've developed a suite of premium Outlook features for people with advanced email and calendar needs. A Microsoft 365 subscription offers an ad-free interface, custom domains, enhanced security options, the full desktop version of Office, and 1 TB of cloud storage.

Outlook – free personal email and calendar from Microsoft Expand your Outlook. We've developed a suite of premium Outlook features for people with advanced email and calendar needs. A Microsoft 365 subscription offers an ad-free interface, custom domains, enhanced security options, the full desktop version of …

CBS New York - Breaking News, Sports, Weather, Traffic and the … N.J. lawmakers introduce bill with new restrictions on carrying guns Democratic state lawmakers introduced what they hope will stand as the most restrictive gun carry laws in the country. Oct 13

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 26 and 52 weeks, each of these approximating a different number of …

Tech | Fox News Tech you didn’t know you needed — 10 handy gadgets worth buying. TECH September 29. Remove your personal info from the top 7 people search sites. Websites exist that track your information ...

Treasury Bills — TreasuryDirect Treasury Bills. We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). When the bill matures, you are paid its face value. You can hold a bill until it matures or sell it before it matures. Note about Cash Management Bills: We also sell Cash Management Bills (CMBs) at ...

Are 2-Year Treasury Notes A Good Investment Right Now? 2-year: 4.34%. This is a risk-free rate of return that is hard to find in other investments. You could invest in I Bonds, which are yielding over 9% at the time of this writing. However, you ...

Best Rewards Credit Cards for 2019 | Credit.com Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card. Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit ...

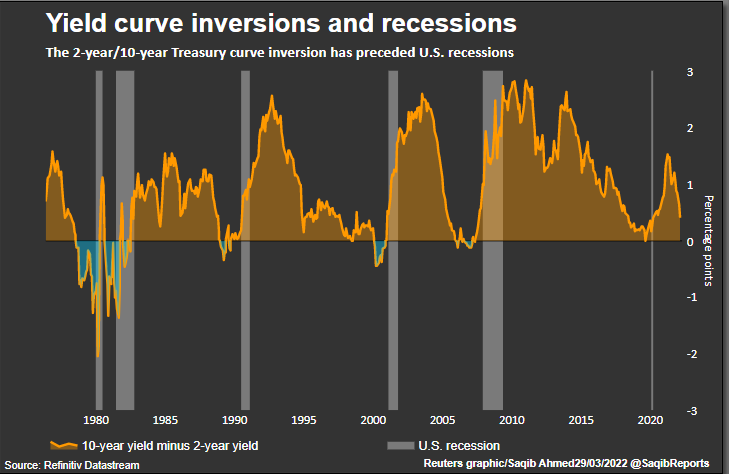

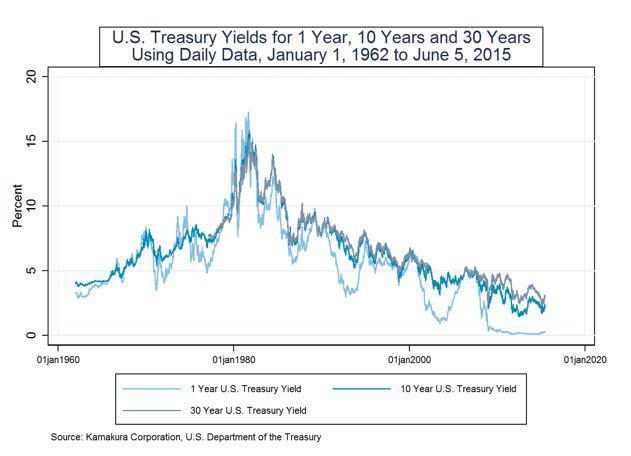

2 Year Treasury Rate - YCharts The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 4.28%, compared to 4.30% the previous market day and 0.35% last year.

myspace.com › pages › blogMyspace Blog You're now in slide show mode. Hitting < pauses the slideshow and goes back. Hitting > pauses the slideshow and goes forward. SPACEBAR resumes the slideshow.

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

.1559146165005.png?w=929&h=523)

Post a Comment for "39 t bill coupon rate"