40 a 10 year bond with a 9 annual coupon

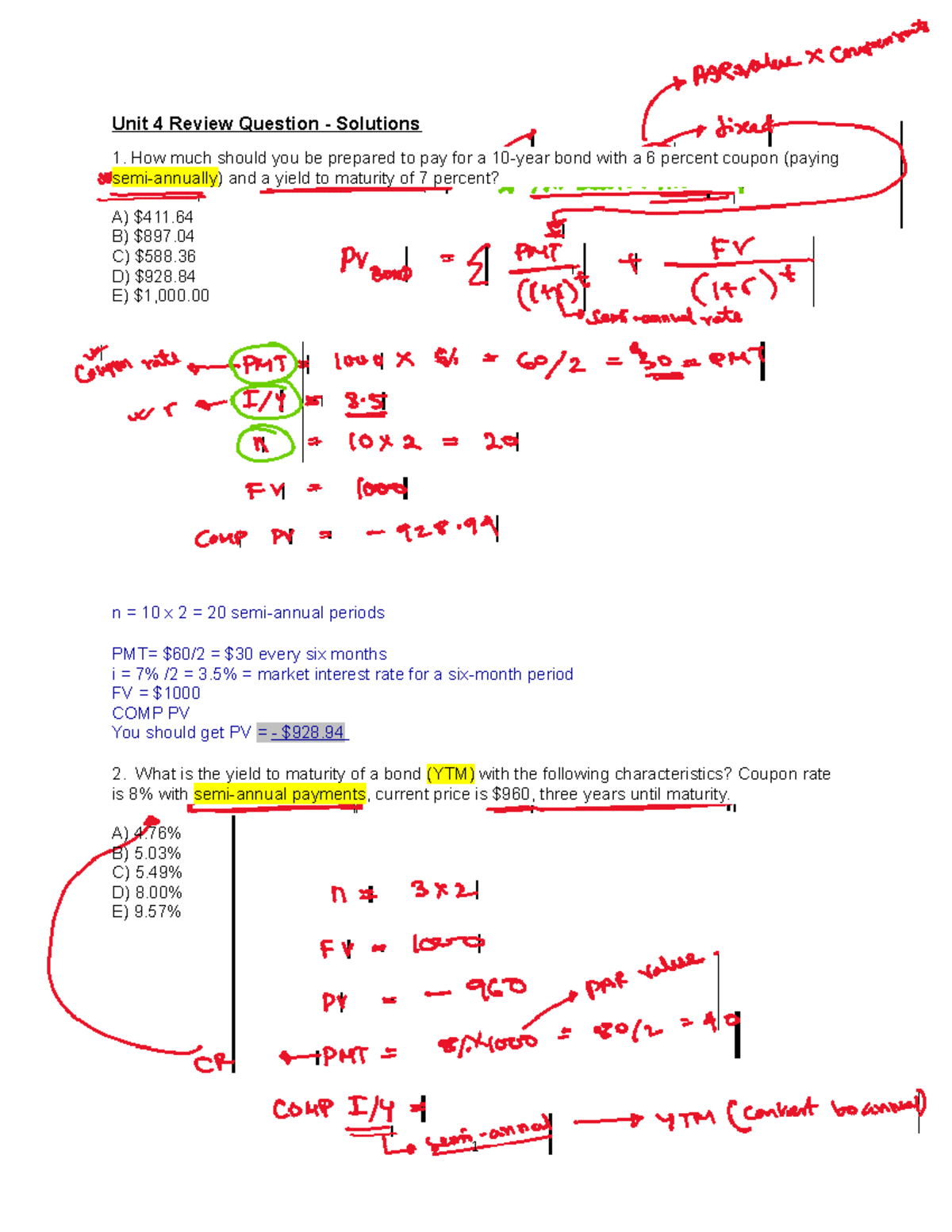

📈What is the price of a two year bond with a 9% annual coupon and a ... We can determine the bond price using the present value formula of a single cash flow for all cash flows. PV=FV/ (1+r)^N FV=future cash flow ( annual coupons for 2 years and face value) annual coupon=face value*coupon rate face value=100 coupon rate=9% annual coupon =100*9% annual coupo n=9 r=discount rate=8% Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If...

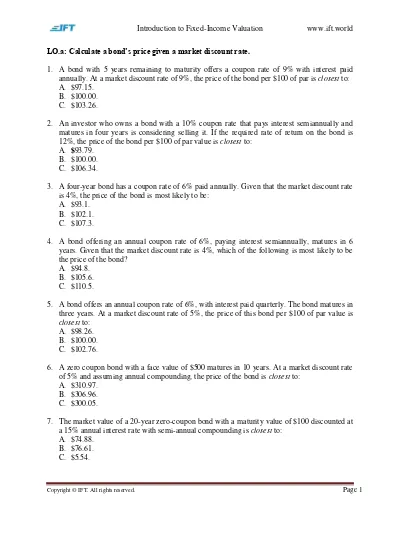

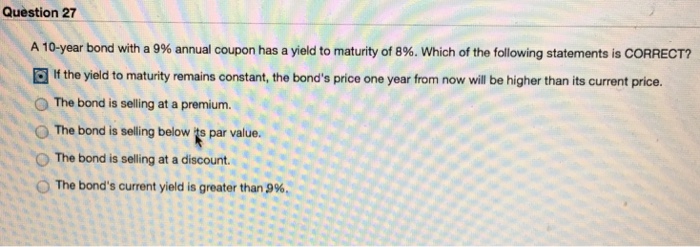

Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Group of answer choices If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond is selling at a discount.

A 10 year bond with a 9 annual coupon

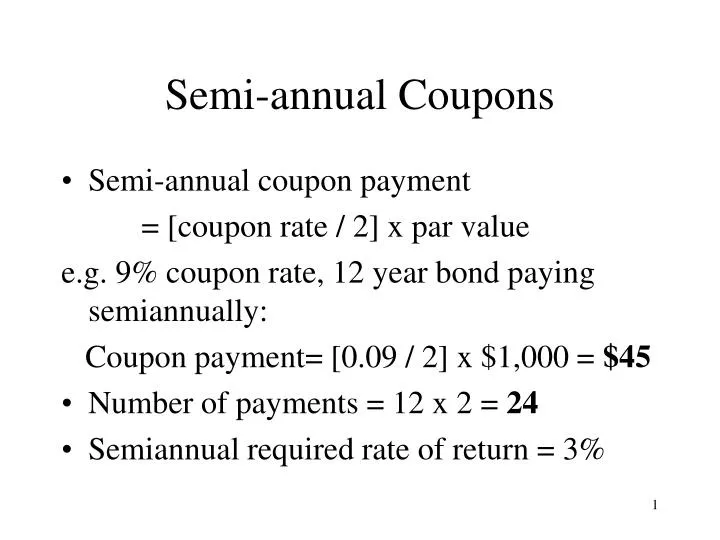

A 10 year bond with a 9 percent semiannual coupon is A 10 year bond with a 9 percent semiannual coupon is currently selling at par A from FIN 101 at Austin College. Study Resources. Main Menu; by School; ... A 10 year bond with a 9 percent semiannual coupon is currently selling at par A. A 10 year bond with a 9 percent semiannual coupon is. School Austin College; Course Title FIN 101; Type. Coupon Payment Calculator How to calculate the annual coupon payment? If you want to calculate the annual coupon payment for a bond, all you have to do is multiply the bond's face value by its annual coupon rate. That means if you have a bond with a face value of $1000 and an annual coupon rate of 10%, then the annual coupon payment is 10% of $1000, which is $100. Yield to Maturity Calculator | Good Calculators Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100 CY = 8.75%, The Current Yield is 8.75% The calculator uses the following formula to calculate the yield to maturity: P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y Where: P is the price of a bond,

A 10 year bond with a 9 annual coupon. [Solved] Bond X is a premium bond making annual pa | SolutionInn Bond X is a premium bond making annual payments. The bond pays a 9% coupon, has a YTM of 7%, and has 13 years to maturity. Bond Y is a discount bond making annual payments. This bond pays a 7% coupon, has a YTM of 9%, and also has 13 years to maturity. If interest rates remain unchanged, what do Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2 A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid... A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d.

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d. Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 What is the price of a two year bond with a 9% annual coupon and a ... 2 years Coupon rate = 9%. Yield to maturity = 8%. Formula to Calculate Bond Price. The formula for bond pricing. is basically the calculation of the present value of the probable future cash flows, which comprises of the coupon payments and the par value, which is the redemption amount on maturity. Solved (1) What is the yield to maturity on a 10 -year, \( 9 | Chegg.com (1) What is the yield to maturity on a 10 -year, 9% annual coupon, $1, 000 par value bond that sells for $887.00?That sells for $1, 134.20?What does the fact that a bond sells at a discount or at a premium tell you about the relationship between r d and the bond's coupon rate? Yield to maturity for $887.00: 11% Yield to maturity for $1, 134, 20: 7% Whether a bond sells at a discount rate or a ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Coupon Bond: Definition, How They Work, Example, and Use Today Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

What is the value of a 10-year, $1,000 par value bond with a 10 ... - Quora When you buy a bond for, say $1000, and the coupon rate is 10% for 10 years, paying you $100 per year. Where is the profit in that? You get the $1000 back at maturity. So you collect $100 of interest for 10 years and receive $1000 of principal at maturity. So you collect a total of $2000 for your $1000 investment. More answers below David Friedman

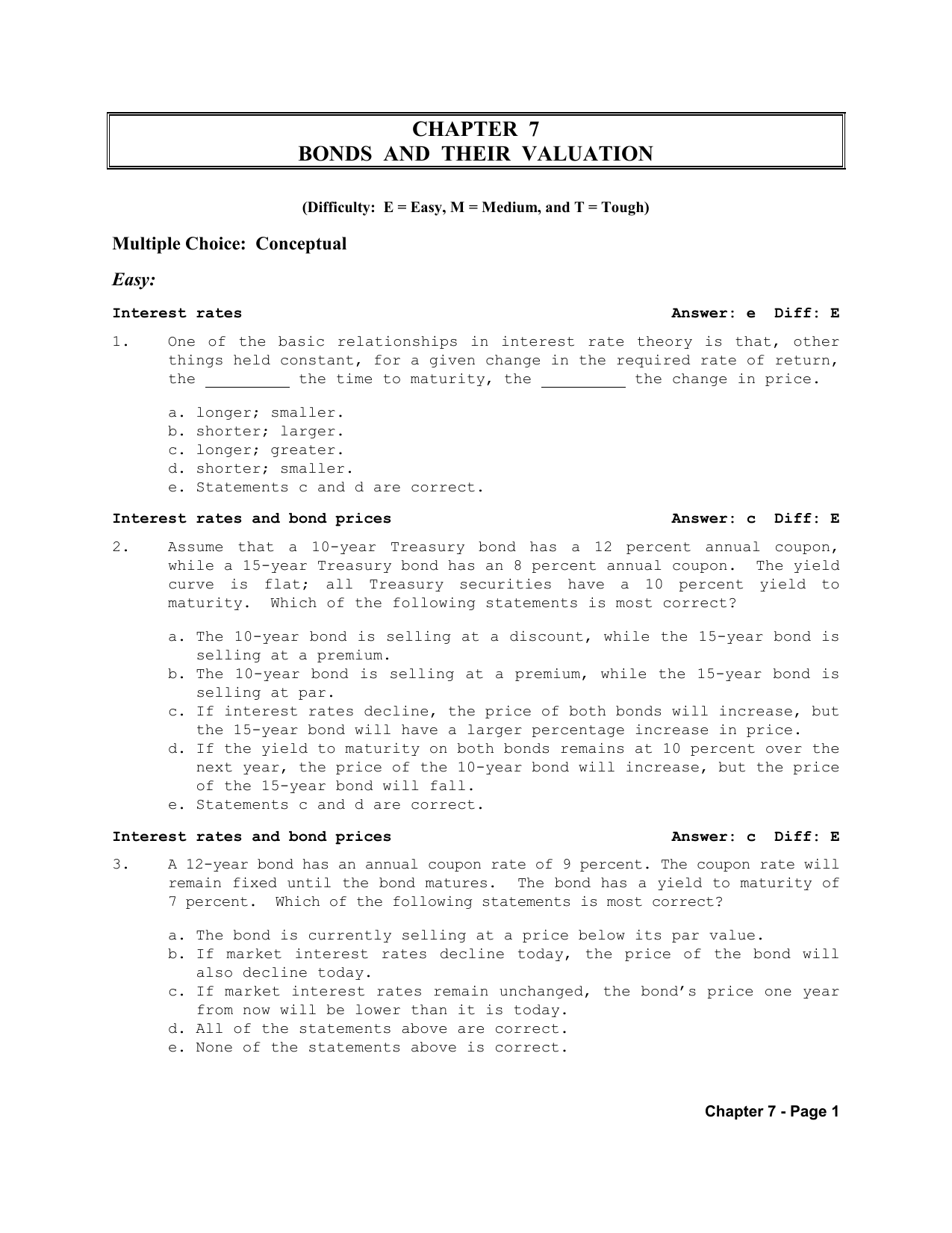

A 10 year annual coupon bond was issued four years A 10-year annual coupon bond was issued four years ago at par. Since then the bond's yield to maturity (YTM) has increased from 7% to 9%. Which of the following statements is true about the current market price of the bond? a. The bond is selling at a discount b. The bond is selling at par c. The bond is selling at a premium d. The bond is selling at book value e.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg See the answer A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value Expert Answer

Finance Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. The bond's current yield is greater than 9%. c.

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The 3. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is … read more JKCPA CPA Bachelor's Degree 844 satisfied customers 5. If a bank loan officer were considering a companys request 5.

[Solved] A bond that matures in 10 years has a 1000 par value The ... Step1 - Calculation for Annual payment of interest A n n u a l I n t e r e s t = F a c e v a l u e × R a t e o f i n t e r e s t = $ 1, 000 × 9 % = $ 90 Step2 - Calculation for value of annual paying bond Value of bonds can be calculated by using 'PV' formula of spreadsheet or Excel The formula is shown below

A 10 Year Bond Pays an Annual Coupon - DerivBinary.com These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple ...

FINN 3226 CH. 4 Flashcards | Quizlet The bond's coupon rate is less than 8%. A A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

Yield to Maturity Calculator | Good Calculators Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100 CY = 8.75%, The Current Yield is 8.75% The calculator uses the following formula to calculate the yield to maturity: P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y Where: P is the price of a bond,

Coupon Payment Calculator How to calculate the annual coupon payment? If you want to calculate the annual coupon payment for a bond, all you have to do is multiply the bond's face value by its annual coupon rate. That means if you have a bond with a face value of $1000 and an annual coupon rate of 10%, then the annual coupon payment is 10% of $1000, which is $100.

A 10 year bond with a 9 percent semiannual coupon is A 10 year bond with a 9 percent semiannual coupon is currently selling at par A from FIN 101 at Austin College. Study Resources. Main Menu; by School; ... A 10 year bond with a 9 percent semiannual coupon is currently selling at par A. A 10 year bond with a 9 percent semiannual coupon is. School Austin College; Course Title FIN 101; Type.

Post a Comment for "40 a 10 year bond with a 9 annual coupon"